As imports from China slow under pressure from the Trump Administration’s “Liberation Day” tariff plan, U.S. importers are increasingly shifting their sourcing strategies toward Southeast Asia, with Indonesia in particular emerging as a strong alternative supplier, according to a report from supply chain visibility platform provider Project44.

While U.S. tariffs on imports from China have been reduced in recent months, their effects continue to ripple through supply chains. Over the past year, shipments from China to the U.S. fell 29% in 2025 compared to the volume in 2024, the report said.

Numbers covering January 2026 shows that this decline is continuing for the foreseeable future with a 35% decline in volume compared to January 2025. That most recent drop is all the more striking because it falls at a time where companies typically order surplus inventory in order to prepare for the Lunar New Year. That annual holiday, which occurred on February 17th this year, is a time when China’s factories shutdown and delays in manufacturing and shipping occur.

China hasn’t taken those hits lying down, but rather set its own tariffs on U.S. goods, impacting exports from the U.S. to China. Shipments from the U.S. to China dropped 37% in 2025 compared to 2024, Project44 found.

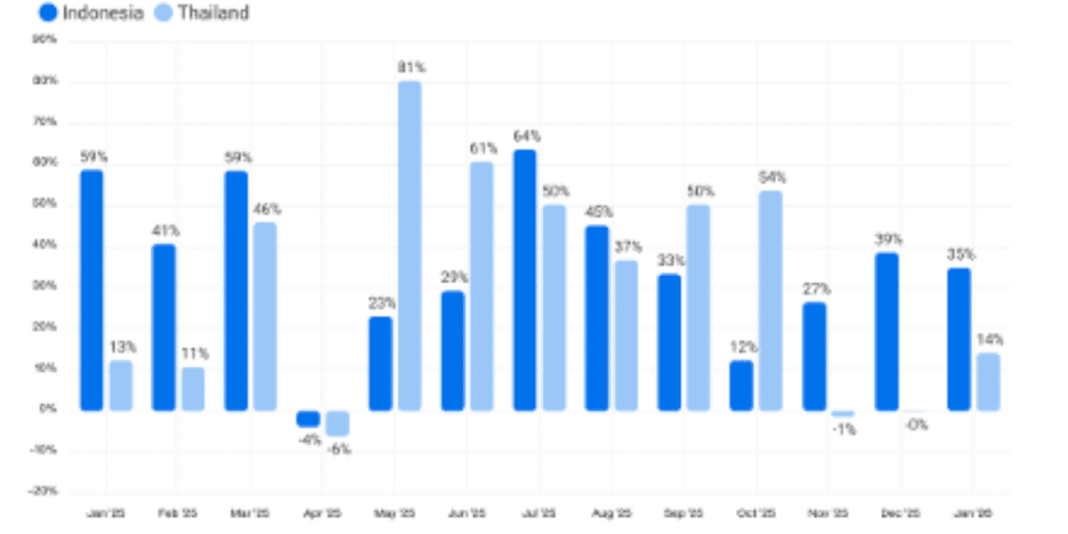

American companies have reacted to those changes by implementing new sourcing strategies, and Indonesia and Thailand are emerging as alternative suppliers. Project44 says imports are up 30% from Thailand and 34% from Indonesia in 2025 compared to 2024.

Looking into 2026, uncertainty persists despite signs of stabilization. A U.S. Supreme Court case will soon determine whether the Administration’s expansive use of tariff authority is constitutional, and several large importers have already filed lawsuits seeking refunds for duties they contend were improperly applied, Project44 noted.