Global trade is integral to the logistics ecosystem, but U.S. logistics real estate demand is fundamentally anchored in domestic consumption, lending it stability amid shifting trade flows and evolving policy, according to a new report from Prologis.

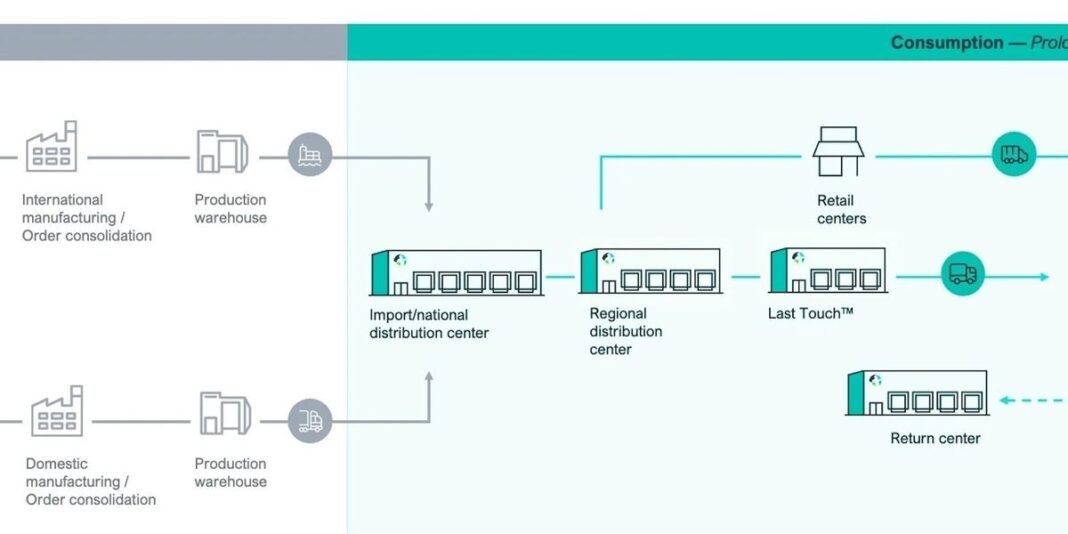

To be sure, global trade policy is in flux, creating real-time challenges for supply chains. But Prologis says that not all locations are equally vulnerable to trade volatility: real estate assets serving end-consumption are more insulated, while those tied to trade flows are more exposed to disruption. In fact, 75% of U.S. logistics real estate demand is tied to regional distribution and local consumption, compared to a fraction of properties that are trade oriented.

But although that stability helps some sites right now, prolonged uncertainty delays important long-term investment decisions, underscoring the need for policy clarity for business leaders to plan around a clear vision of the future, Prologis said in a paper titled “Trade in Flux: What Global Shifts Mean for U.S. Logistics Real Estate.”

That lack of clarity in trade policy is already forcing customers to delay decisions. Uncertainty, not tariffs themselves, is slowing leasing activity and prompting interest in shorter, more flexible terms, Prologis said.

Short-term measures are also driving demand for flexible solutions. Companies are pursuing overflow space, third party logistics (3PL) assistance, and Foreign Trade Zones (FTZ) as stopgap tools to navigate volatility.

In addition, supply chain diversification—including nearshoring—is rising gradually. Mexico and Asia (except China) are gaining U.S. import share, but most structural investments remain two to five years out as companies await clearer policy signals.