Economic activity expanded across the logistics industry in July, driven by strong activity among middle-mile firms that are bearing the brunt of efforts to stay ahead of trade-related uncertainties, according to the latest Logistics Managers’ Index (LMI) report, released today.

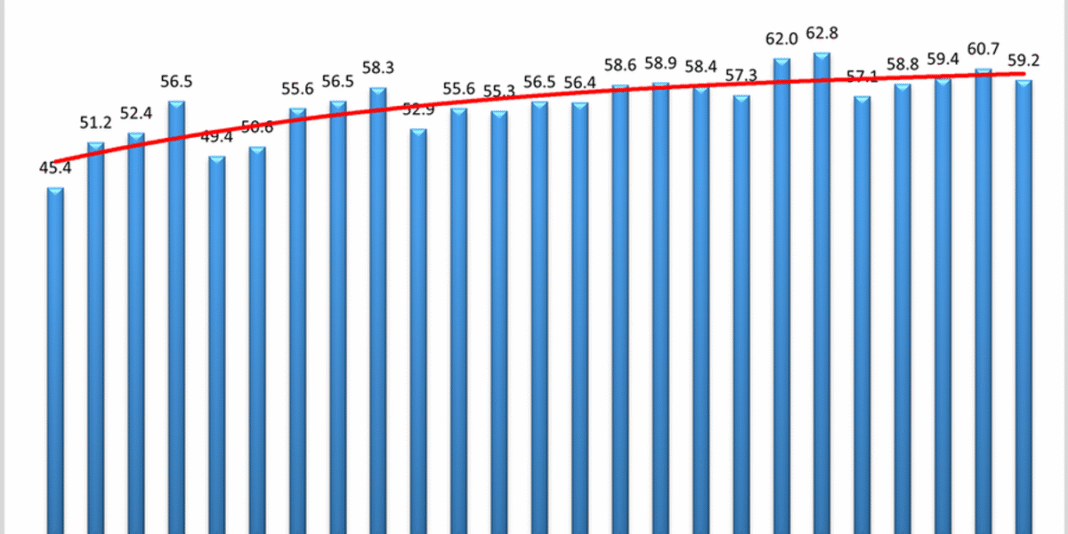

The LMI registered 59.2 in July, down from June’s reading of 60.7, but still indicating moderate expansion across logistics markets. The LMI score is based on a monthly survey of logistics managers nationwide and tracks transportation and warehousing activity. An LMI reading above 50 indicates expansion in the sector; a reading below 50 indicates contraction.

July’s report tracked strong activity among upstream and smaller businesses—many of them wholesalers, distributors, and logistics service providers who are experiencing higher inventory levels and tighter capacity compared to their downstream, retail counterparts. These are middle-mile companies that have stocked up ahead of tariff deadlines as a buffer against the uncertain economic climate.

“Continuing the trend we have observed over the last three months, logistics expansion is being disproportionately driven by smaller firms … ,” the LMI researchers wrote in their July report, noting an LMI score of 62 for those smaller companies compared to an overall score of 56 among larger firms. “Essentially, [smaller firms] are holding the high levels of inventory that were brought into the U.S. to avoid tariffs but have not been moved down to retailers yet. The expense of these inventories is high, but the idea is that they will act as buffers to the current uncertainty.”

In comparison, larger companies and downstream retailers are reporting contracting inventories, more capacity, and lower price expansion as they attempt to maintain Just-in-Time inventory management strategies to avoid higher costs, according to the report.

On the transportation side, the LMI’s metrics reveal a “holding pattern” in the freight recovery that began last year, as transportation utilization was up but capacity and prices remained consistent with June’s readings.

The report’s 12-month outlook calls for continued expansion across logistics, with respondents predicting overall LMI growth of 62.6—a reading that’s down slightly from June but above the all-time average future growth prediction of 61.5

The LMI is a monthly survey of logistics managers from across the country. It tracks industry growth overall and across eight areas: inventory levels and costs; warehousing capacity, utilization, and prices; and transportation capacity, utilization, and prices. The report is released monthly by researchers from Arizona State University, Colorado State University, Rochester Institute of Technology, Rutgers University, and the University of Nevada, Reno, in conjunction with the Council of Supply Chain Management Professionals (CSCMP).