U.S. container import volumes stabilized in June after a sharp drop in May, as American businesses continued to wait for clarity from the Trump Administration’s swiftly shifting series of trade policy announcements, according to a report from supply chain software vendor Descartes.

“While U.S. container imports posted a small rebound in June, the effects of U.S. policy shifts with China in particular are visible for a second consecutive month,” Jackson Wood, Director of Industry Strategy at Descartes, said in a release. “As U.S. importers continue to assess and adapt their supply chains, two key trade deadlines—the July 9 expiration of the pause on sweeping Liberation Day tariffs and the August 10 expiration of the U.S.–China trade truce—may create further pressure on businesses to bolster supply chain resilience in the wake of a quickly fluctuating trade environment.”

As one example of those fluctuations, the White House announced on Monday that it would further delay the “pause” of its threatened Reciprocal Tariffs from the first deadline extension of July 9 until August 1.

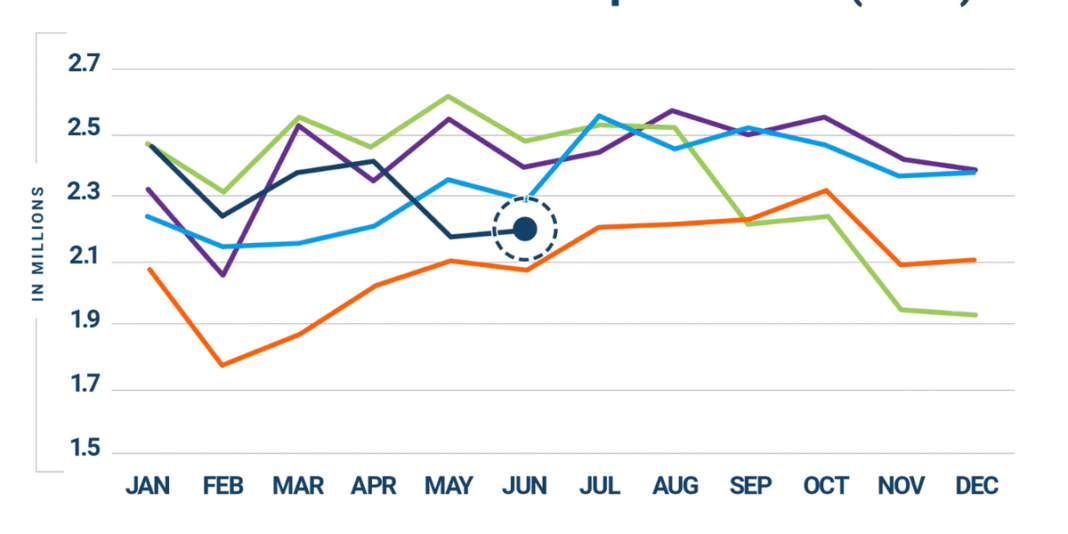

By the numbers, the paper found that U.S. container import volumes rose in June by a modest 1.8% over the previous month’s sharp 9.7% decline. Imports from China were up a slight 0.4% in June (639,300 TEUs) compared to May, but were down 28.3% compared to June 2024.

In addition, China’s share of total U.S. containerized imports fell to 28.8% in June, hitting a four-year low and down substantially from the high of 41.5% in February 2022. Among other top countries of origin, several Southeast Asian nations posted robust volume growth in June over May, including Vietnam at 7.7% followed by Indonesia at 17.3%, Thailand at 8.6%, and Italy at 9.0%, suggesting continued momentum for diversifying sourcing strategies (see Figure 2).

Amidst those shifts, U.S. port dynamics shifted again in June, with top West Coast ports regaining the lead in market share over top East and Gulf Coast ports by a 6.7% margin. Overall, port transit time delays improved substantially in June, led by the ports of Long Beach and Los Angeles.

The June “Global Shipping Report” is Descartes’ forty-seventh installment since beginning its analysis in August 2021.