Preliminary net orders for Class 8 trucks/tractors in North America for June totaled just 8,900 units, the lowest for a June month since 2009, according to transportation market analyst firm FTR.

Although June typically experiences a modest month-over-month increase, ongoing tariff volatility coupled with economic and freight market uncertainty led many fleets to scale back their orders, FTR said.

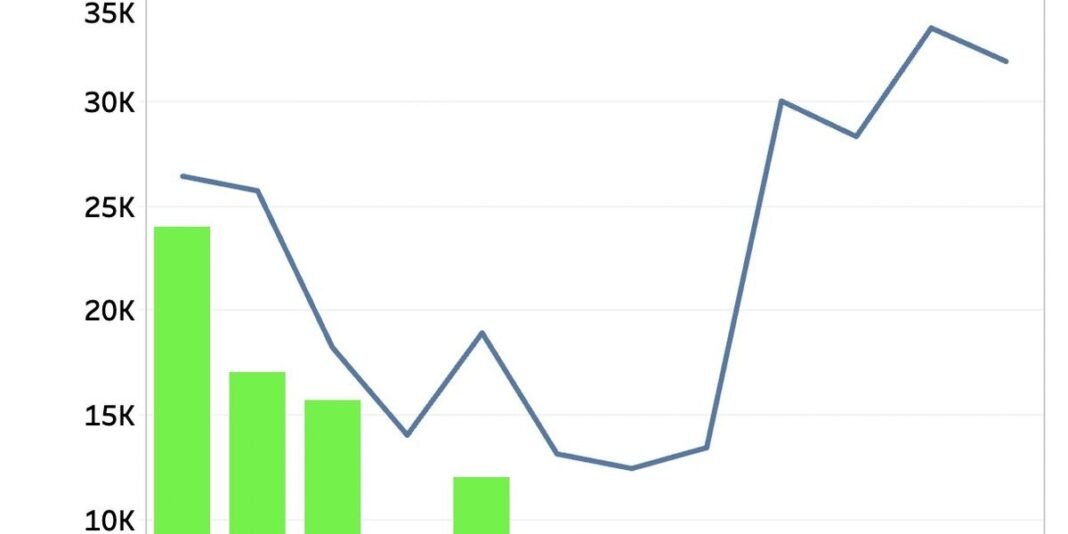

The result for the month was a total that came in significantly below the 10-year average of 19,213 units for June, marking declines of 25% month-over-month and 36% year-over-year. Viewed through a slightly longer lens, net orders are currently down 15% for the 2025 order season so far (September 2024 through June 2025). That dip has been led by a 32% year-over-year decline in net orders during 2025 to date.

According to FTR, the culprit is a lack of confidence triggered by recent tariff hikes – most notably the increase from 25% to 50% on steel, aluminum, and fabricated components that took effect June 4 – that have significantly raised production costs, just as demand has deteriorated.

“Market uncertainty is further heightened by the potential implementation of Section 232 tariffs on Class 8 trucks and their components along with anticipated revisions to EPA 2027 NOx emissions standards. As a result, many fleets are postponing equipment purchases,” Dan Moyer, senior analyst, commercial vehicles, said in a release. “Record-high inventories are placing additional downward pressure on demand and production.”