U.S. importers face a busy summer season as they place orders to bring goods into the country in time for the Fall back to school season and the Winter holiday peak, even as the clock is ticking down on the Trump Administration’s tariff pause.

Those deadlines are coming up fast, with the pause set to expire on July 9 for the White House’s “reciprocal” tariffs and on August 14 for the U.S.-China de-escalation, according to an analysis by Freightos. No nations but the U.K. have yet announced permanent trade deals to extend those tariff pauses, so the original terms could snap back into effect on those dates, according to Judah Levine, Freightos’ head of research.

Trading terms are further complicated because the White House policy is unclear on whether goods will be exempt from tariffs if they arrive in the U.S. by those deadlines or if they merely need to be loaded at origins by those dates. The difference is significant because ocean shipments from the Far East would have to depart foreign shores in the next week or two to arrive in the U.S. before July 9, the report said.

In the meantime, maritime import costs are climbing fast due to the rush of shipments that began after the May 12 pause announcement, and corresponding general rate increases (GRIs) imposed by ocean carriers. Container ship operators are also struggling to reposition vessels that shifted to other freight lanes when demand suddenly dried up while the tariffs were still being threatened, now leaving those ships in the wrong locations to handle the current shipment boom, Freightos said.

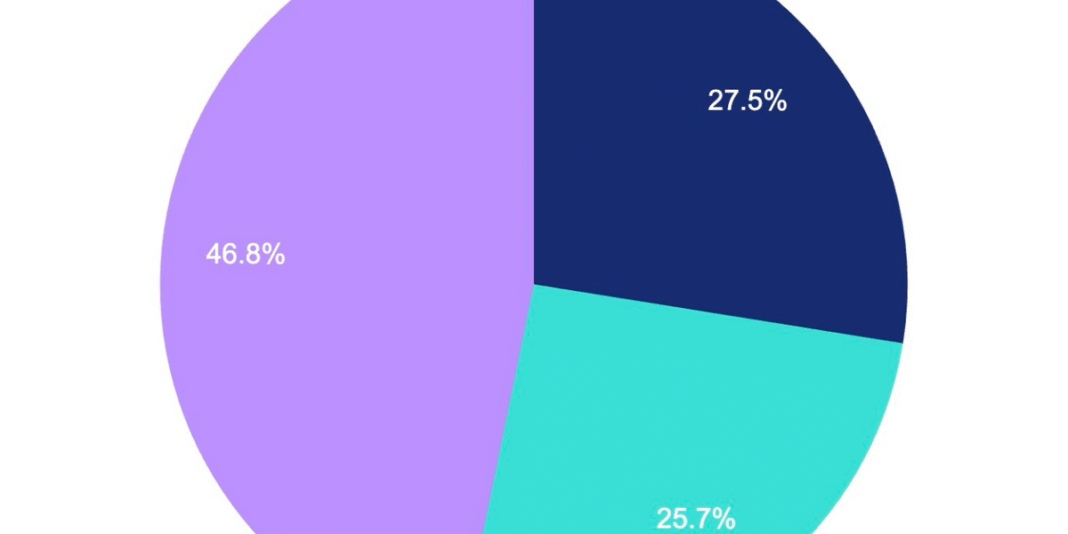

But while those conditions put pressure on U.S. companies to source goods from domestic sources instead of foreign providers, that shift is easier said than done. Only 6% of U.S. businesses have successfully shifted to domestic production despite 30% attempting to do so, according to a Freightos survey of more than 100 small and mid-sized importers.

And in turn, that means U.S. supply chains could see a growing “bullwhip effect,” since 43% of businesses who froze imports in April are now rushing their shipments to catch up, creating a compressed early peak season that will likely cause summer congestion, Freightos said.

A similar assessment came from supply chain risk management consultant Everstream Analytics, which said that during the 90-day reduction period, increased U.S.-China shipments are expected as companies rapidly import goods before tariffs are added or resumed. Therefore, increased port congestion is likely, especially at ports that handle high volumes of U.S.-China trade, including the Ports of Los Angeles/Long Beach and Boston, Jena Santoro, Everstream’s Global Head of Research & Analytics, said in a statement.